Grid trading operates by placing orders at predefined price levels, spaced either equidistantly or customized, both above and below the current market price. Each level represents a point where the system will execute an action (opening a buy or sell order).

One of the main peculiarities of grid trading is that it doesn’t rely on predicting market direction. Orders are placed automatically at grid levels based on price movement.

Types of orders:

Grid symmetry:

The grid system does not require detailed analysis to predict market direction. Its peculiarity lies in the ability to generate profit by leveraging natural price movements, whether the market is ranging or trending.

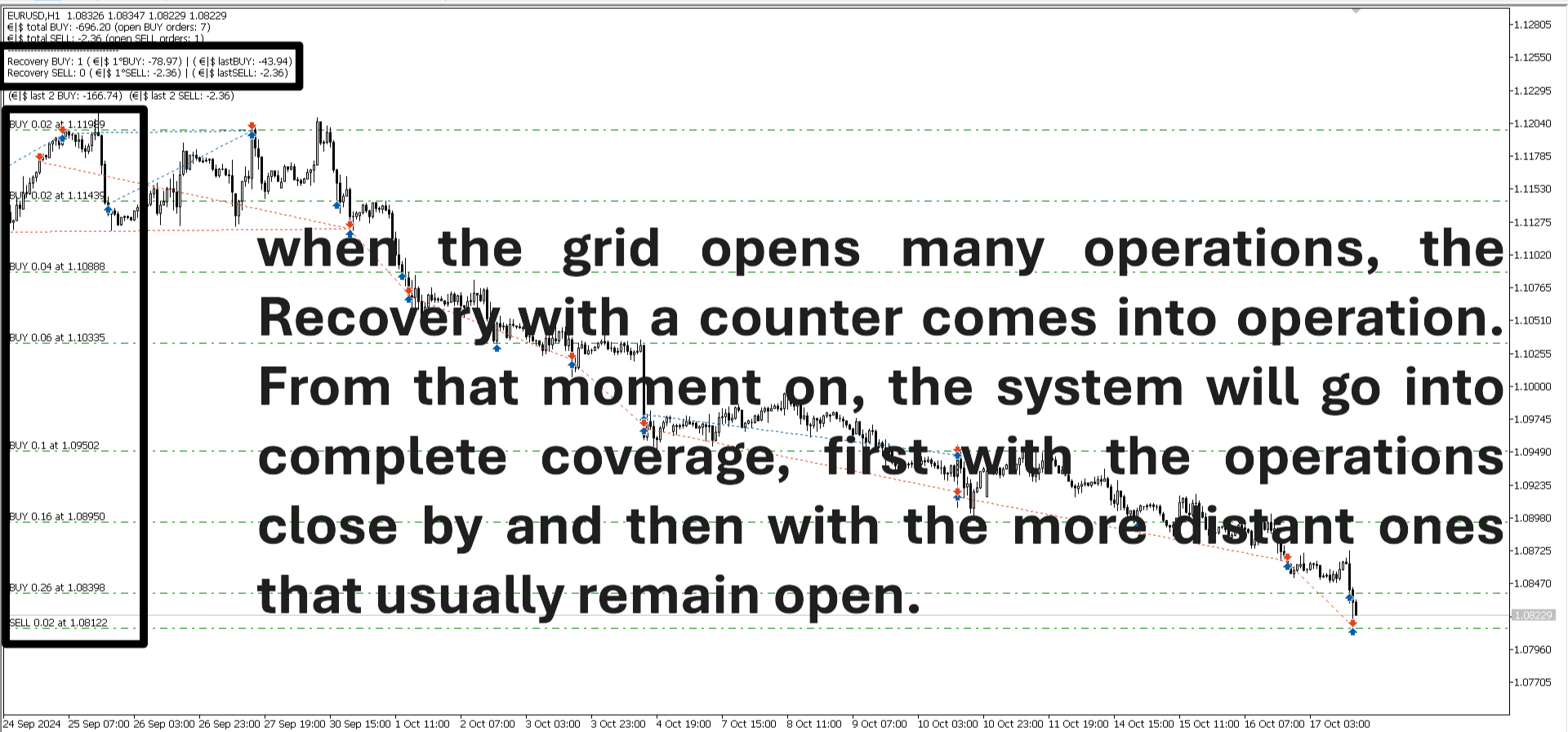

The system accumulates positions as the price moves along the grid. This is a key feature but also a potential risk.

Grid trading is designed to capitalize on small price movements (pips). Each time the price reaches a grid level and reverses toward the previous one, the system can close positions in profit.

Grid systems are highly customizable, allowing traders to adapt the strategy to different market conditions and trading styles.

Grid trading requires significant margin to maintain multiple open positions. As the price moves along the grid, new positions are opened, increasing margin usage.

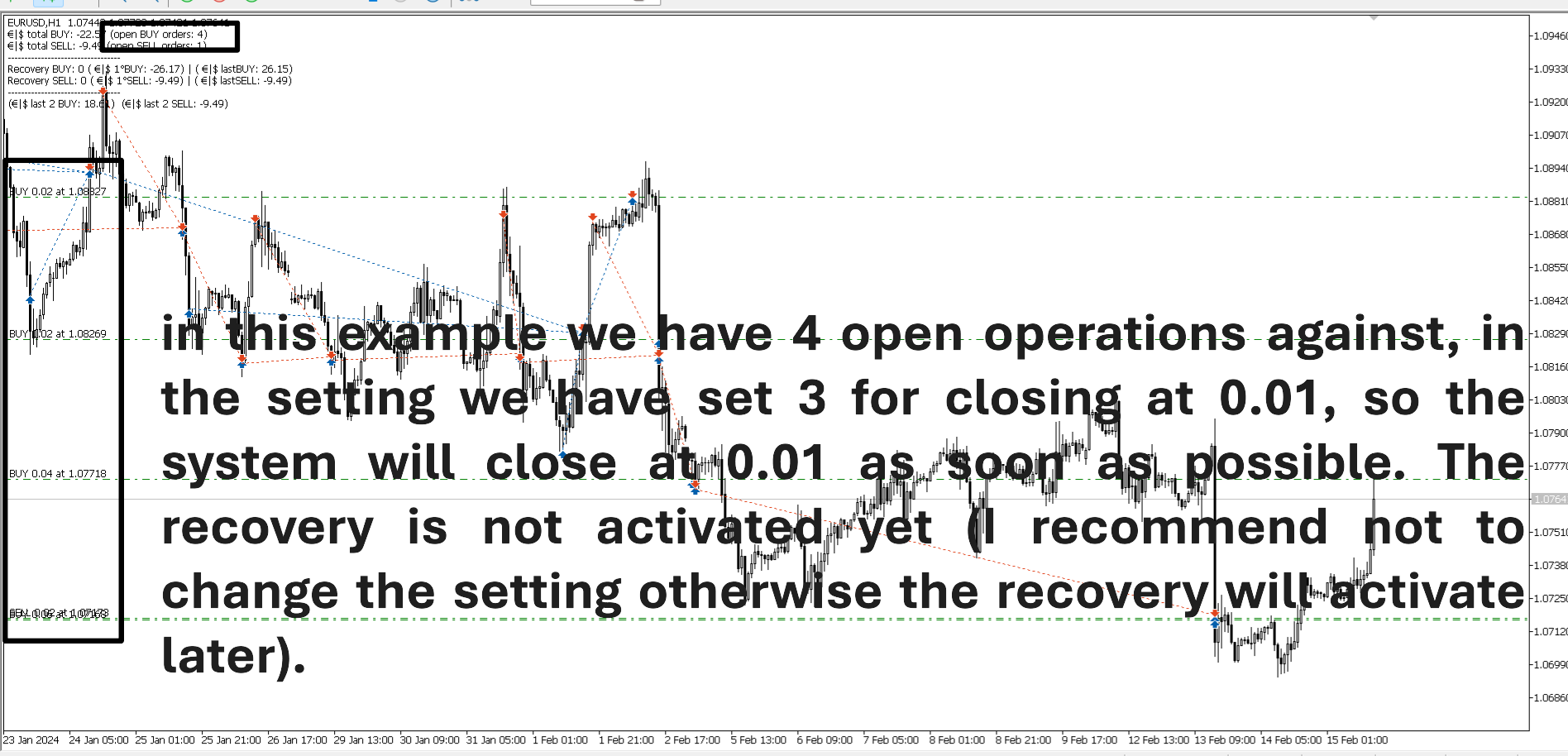

A major peculiarity of the grid system is its tendency to accumulate high drawdowns when the market moves in one direction without reversals.

A grid system can operate in two main ways to close positions:

The grid strategy is not universal and performs best under specific market conditions:

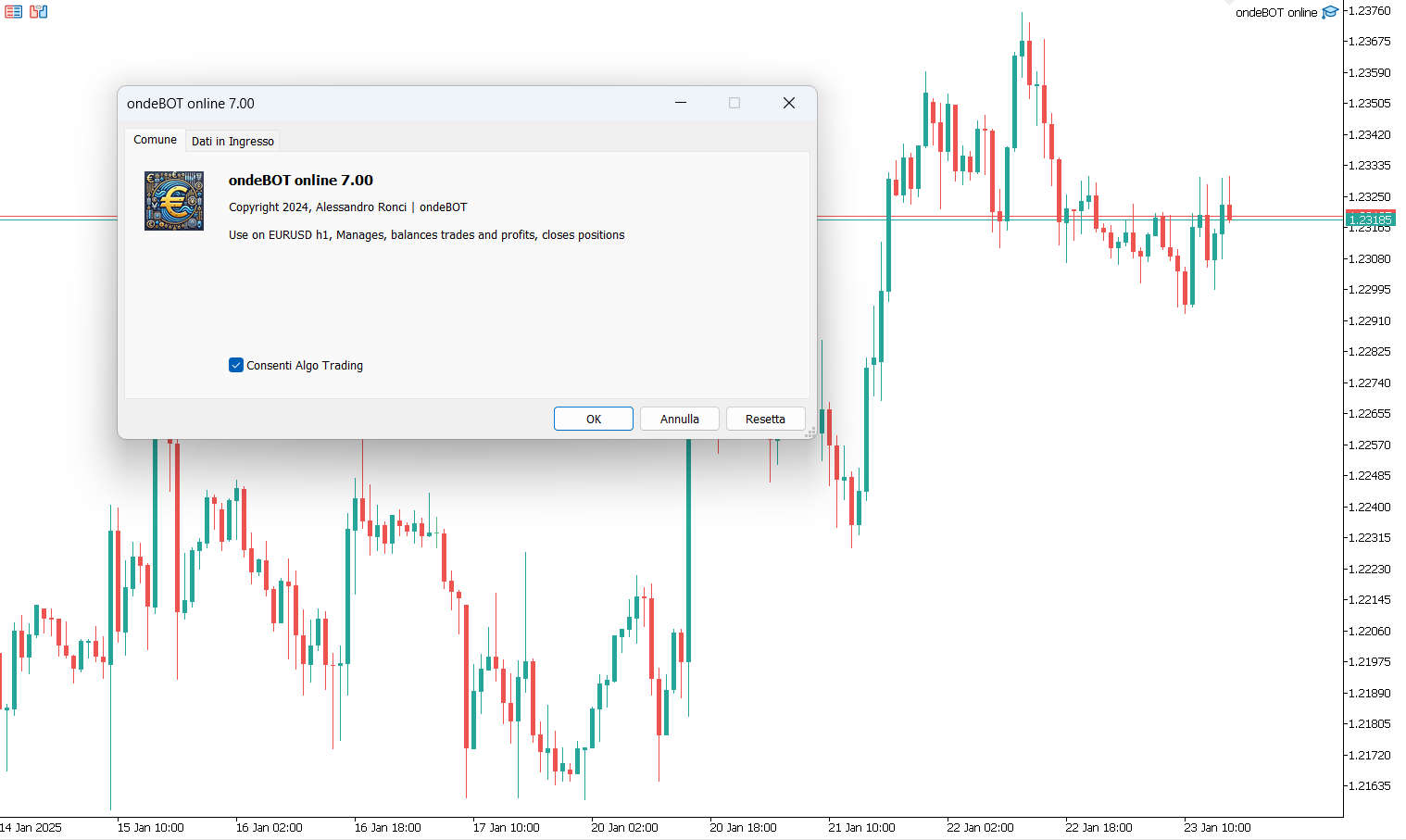

by inserting the expert in the graph the properties appear

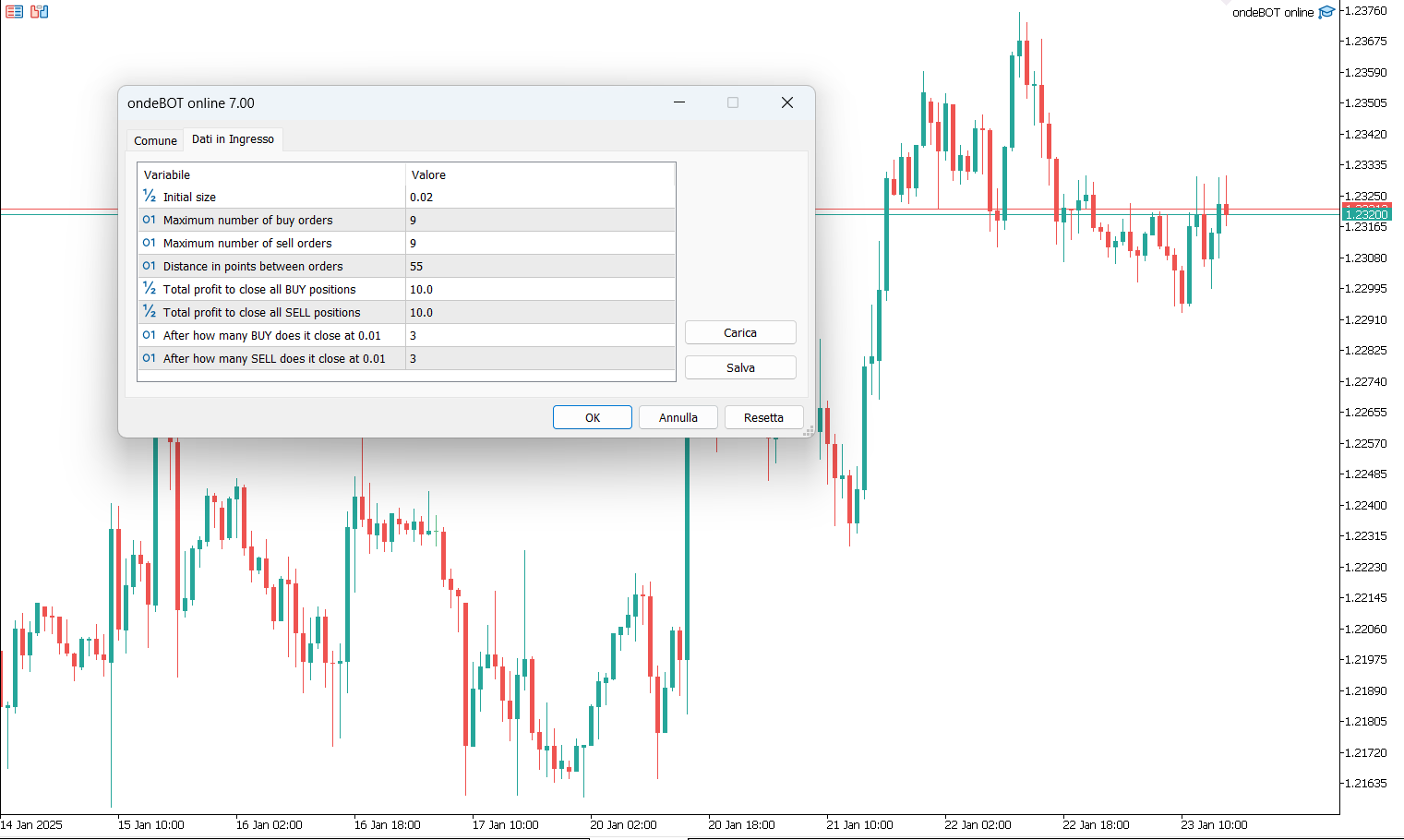

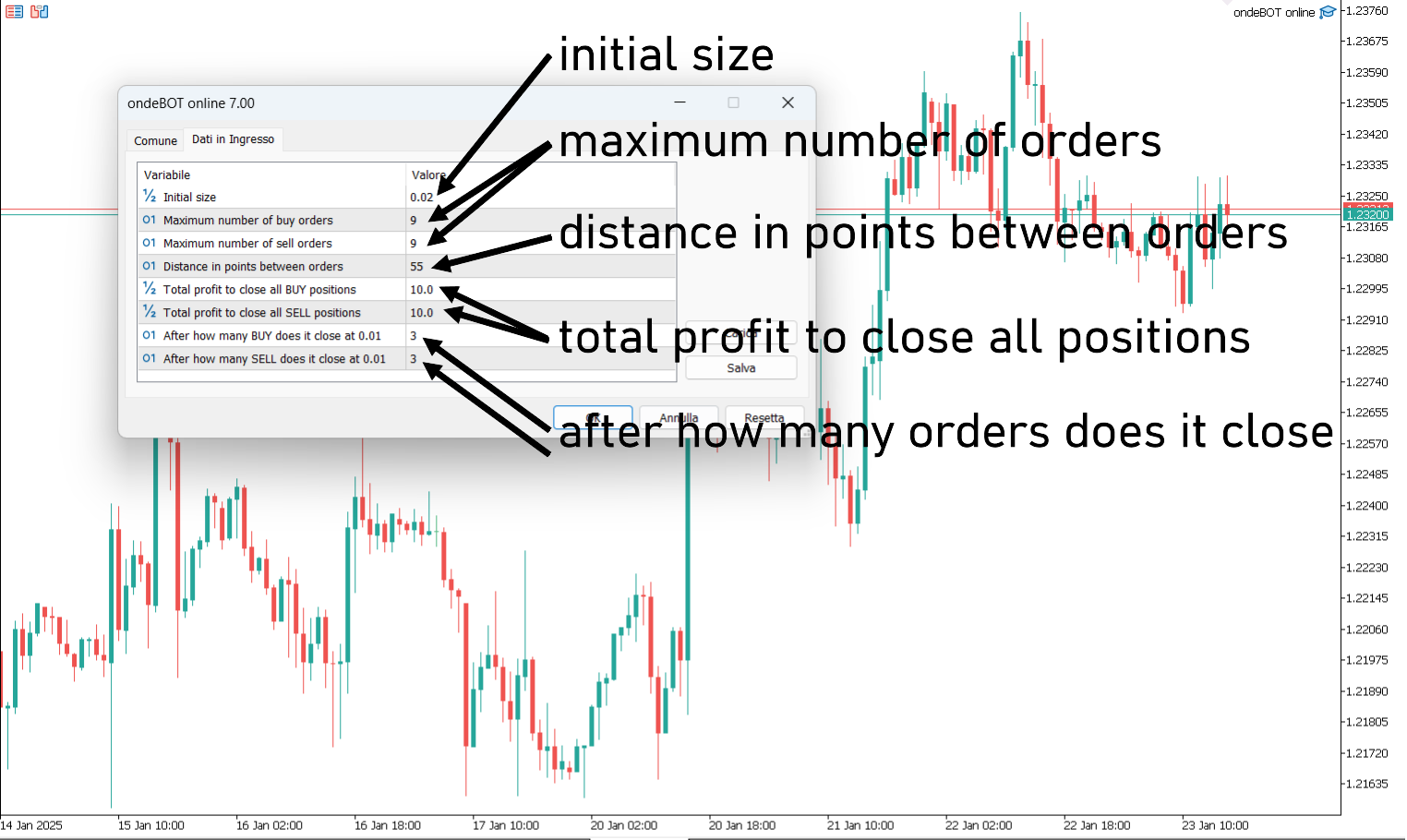

You can always enter your settings in the data session

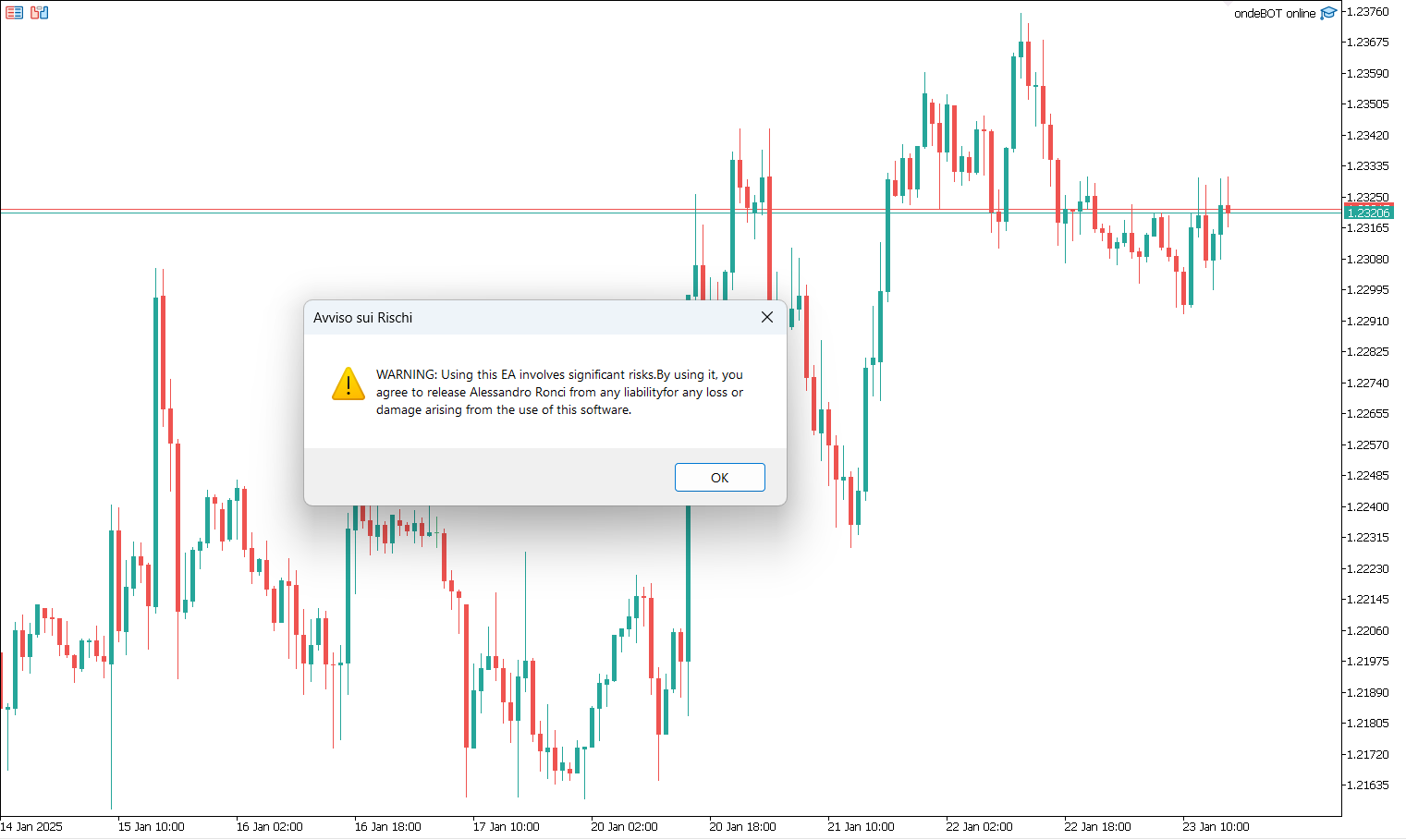

This alert reminds you that trading is a dangerous job and by activating the expert you are the only one responsible.

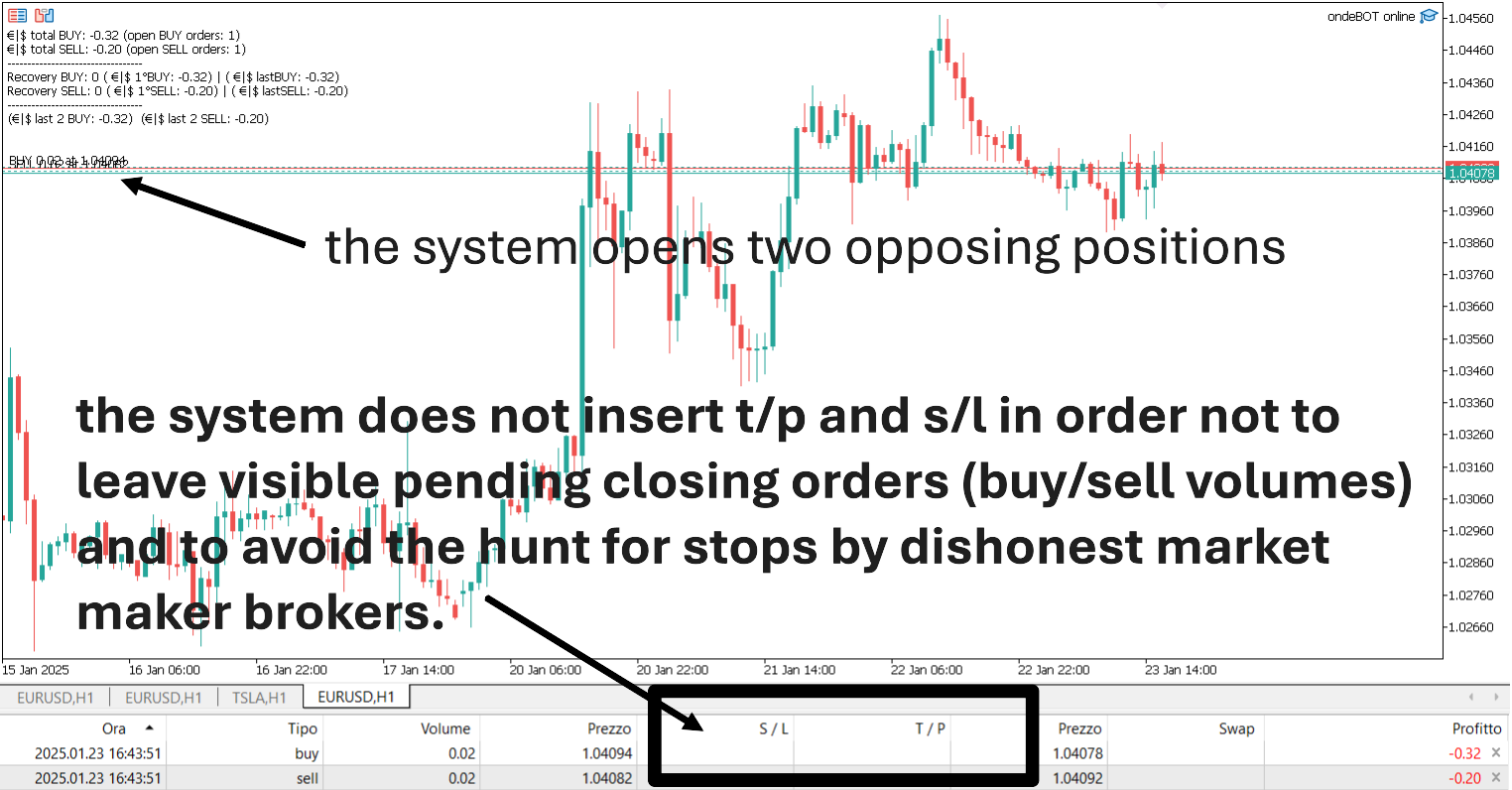

By accepting the disclaimer the expert activates and opens the first two operations very close to each other

This setting is very important

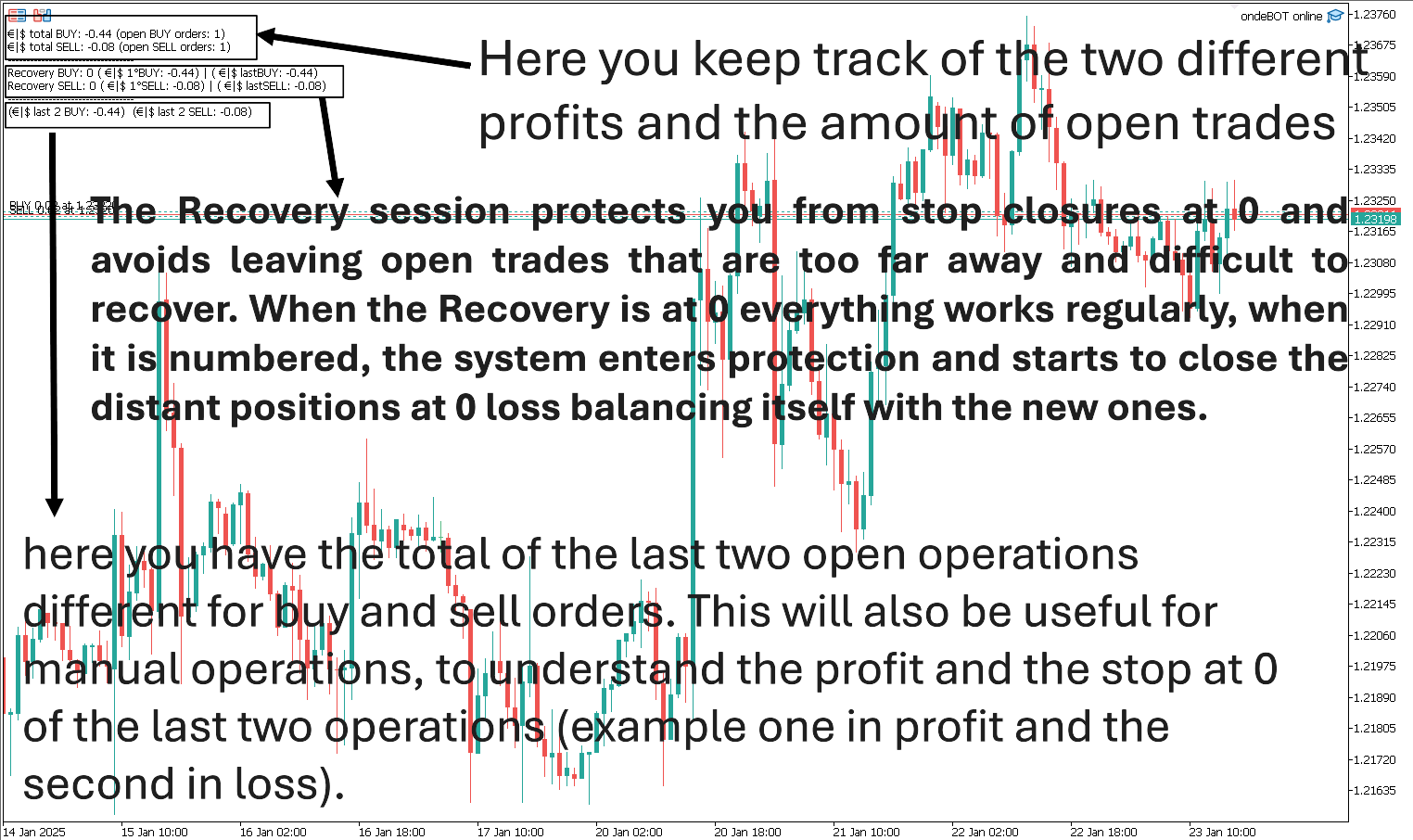

Technical data on operation

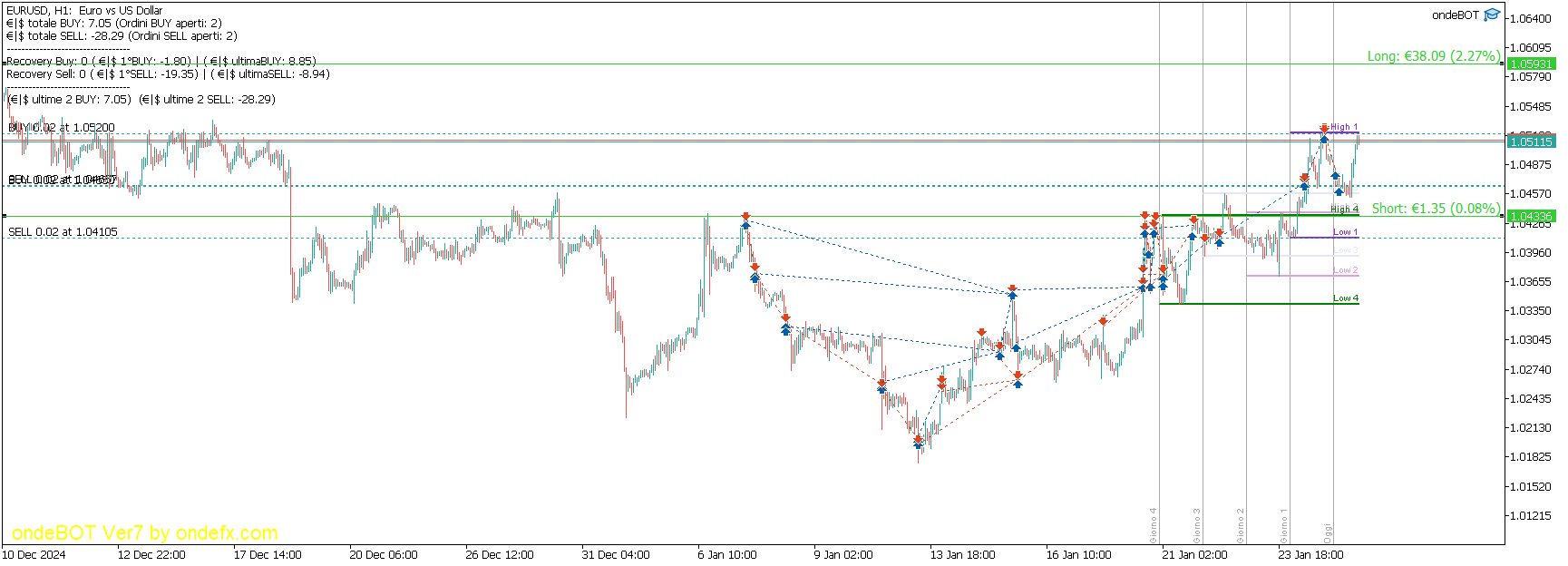

The data visible on the expert are used to check if everything is going well

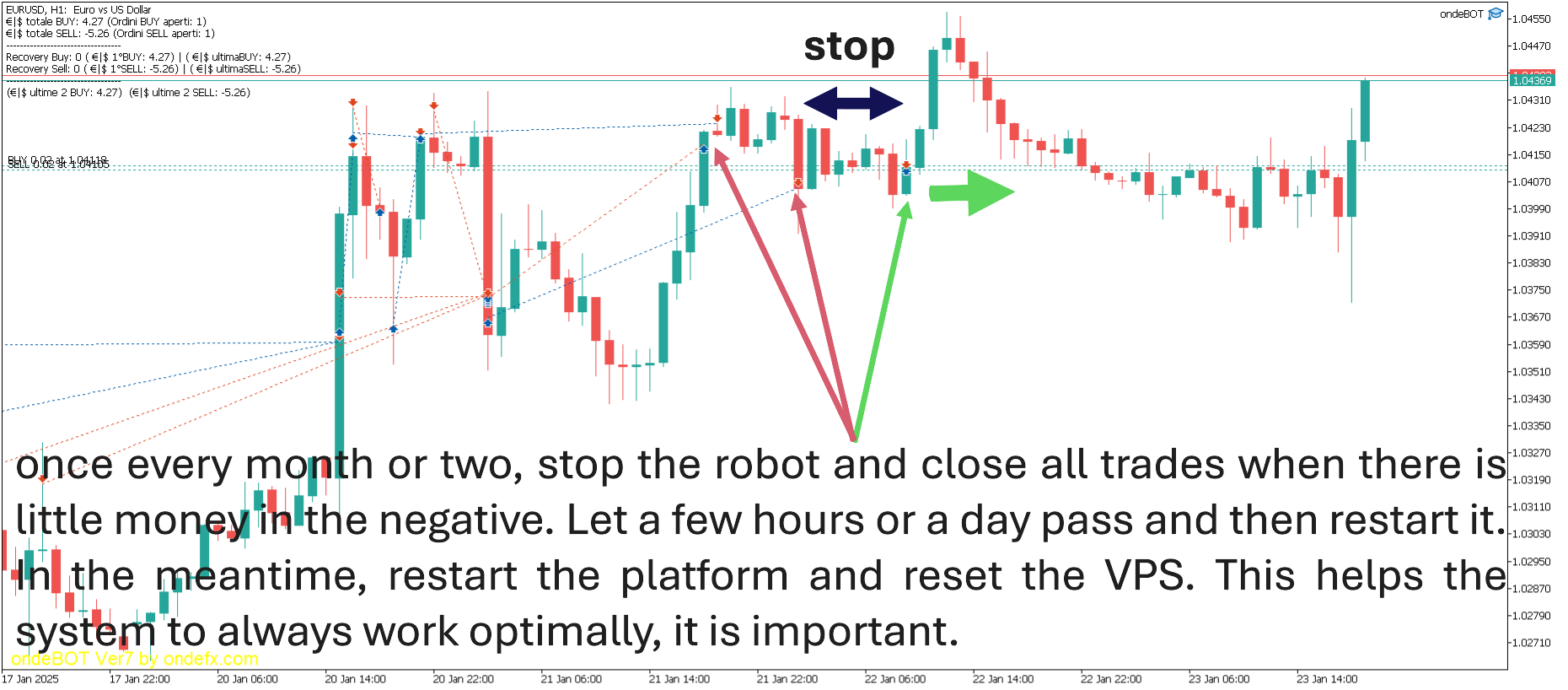

resetting everything is important to keep everything clean

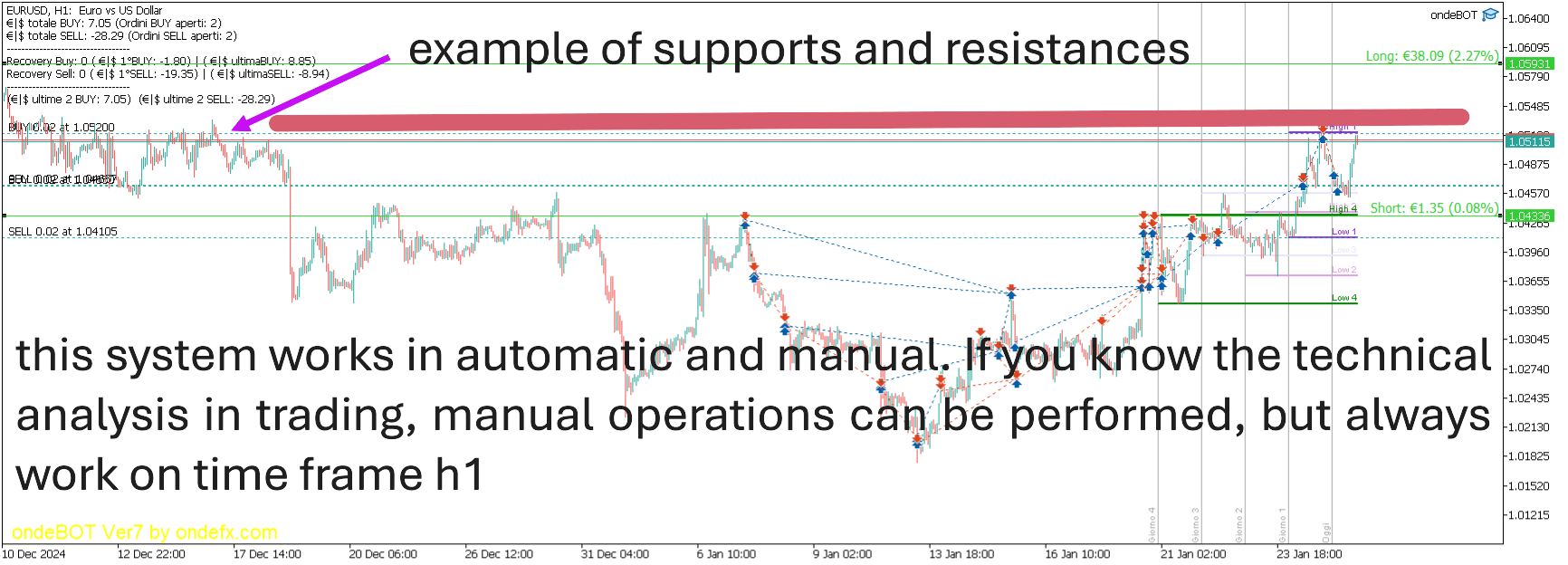

manual operations can be performed, but always work on time frame h1. There is no option in the settings, you will have to close the positions yourself